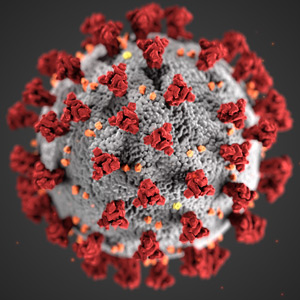

The global fallout from the miserable phytosanitary conditions at the Huanan Market in Wuhan, China, will change the fortunes of the twenty-first century. The countries at the center of the global economy, especially the eurozone, are now heading not only toward being at the receiving end of the worst pandemic since the Spanish flu of 1918–20, but also toward the abyss of an unprecedented economic recession. Amidst all this, in March 2020, the core of the European Union’s neoliberal fiscal policy framework, the Maastricht criteria, were put out of action. But what will follow next?

The global fallout from the miserable phytosanitary conditions at the Huanan Market in Wuhan, China, will change the fortunes of the twenty-first century. The countries at the center of the global economy, especially the eurozone, are now heading not only toward being at the receiving end of the worst pandemic since the Spanish flu of 1918–20, but also toward the abyss of an unprecedented economic recession. Amidst all this, in March 2020, the core of the European Union’s neoliberal fiscal policy framework, the Maastricht criteria, were put out of action. But what will follow next?

Italian Prime Minister Giuseppe Conte has already called, with good reason, for special “corona bonds” to help EU states finance desperately needed health spending and economic rescue programs. With 20,465 coronavirus deaths as of April 14, 2020, Italy has ample reason to call for such “corona bonds.” The same applies to the other most seriously affected EU countries, Spain (18,056 deaths) and France (14,967 deaths). The idea is also welcomed by a growing number of leading global economists—but not by Austrian Federal Chancellor Sebastian Kurz, one of the European leaders whose country and whose banks, like those of Germany and the Netherlands, were among the absolute winners in the eurozone redistribution of wealth since the 2008 crisis, to the detriment of the European South. Kurz, in many ways now the absolute trendsetter of center-right politics in Europe (at the pace that Germany’s Angela Merkel, by her perennial indecisiveness, leaves an ever bigger vacuum), was very quick to refer the suffering in Italy back to the same old European Stability Mechanism (ESM) that already caused so much stagnation in the European South since 2008.